does corelogic pay property taxes

That means that a home with a value of 200000 on average annually pays about 2620 in property taxes according to research done by CoreLogics data team. That is a 1000 savings assuming a 2 tax rate.

Taxq Services National Tax Search Corelogic

That way you dont have to keep up with the payment deadlines and youre not forced to shell out hundreds or thousands of dollars all at once to cover your taxes.

. Teamwork was not accepted and favoritism was a huge issue. 2 of 200000 original assessed value 4000. Information about Core Logic Tax Services was first submitted to Scambook on Jan 28 2014.

When property taxes become delinquent the lenders security interest in the property may be at risk and the lender may step in and pay these delinquent amounts to protect their lien priority. A free inside look at CoreLogic hourly pay trends based on 1 hourly pay wages for jobTitleCount jobs at CoreLogic. According to a 2016 analysis by CoreLogic.

Posted Aug 8 2012 0655. Work culture was not the greatest. Average CoreLogic Tax Specialist yearly pay in the United States is approximately 32914 which is 47 below the national average.

Yet it does not have to pay property taxes thanks to a 2000 Illinois Appellate Court ruling in the case called Big. Corelogic Tax Services LLC-----. On average users reported 105637 of damages.

They did this apparently back in 2005 through 2007. IRVINE Calif September 25 2019 CoreLogic NYSE. Hourly Pay posted anonymously by CoreLogic employees.

When some property owners are. I am looking at making an offer on a vacant property it is not currently listed for sale however I see where Core Logic has been paying the taxes for several years and they are not the owner. Credit card or debit card payments In-office payments.

When your insurance or property tax bill comes due the lender uses the escrow funds to pay them. Once paid the lender may then establish an escrow account to be repaid and to accumulate. Posted Jan 23 2019 1424.

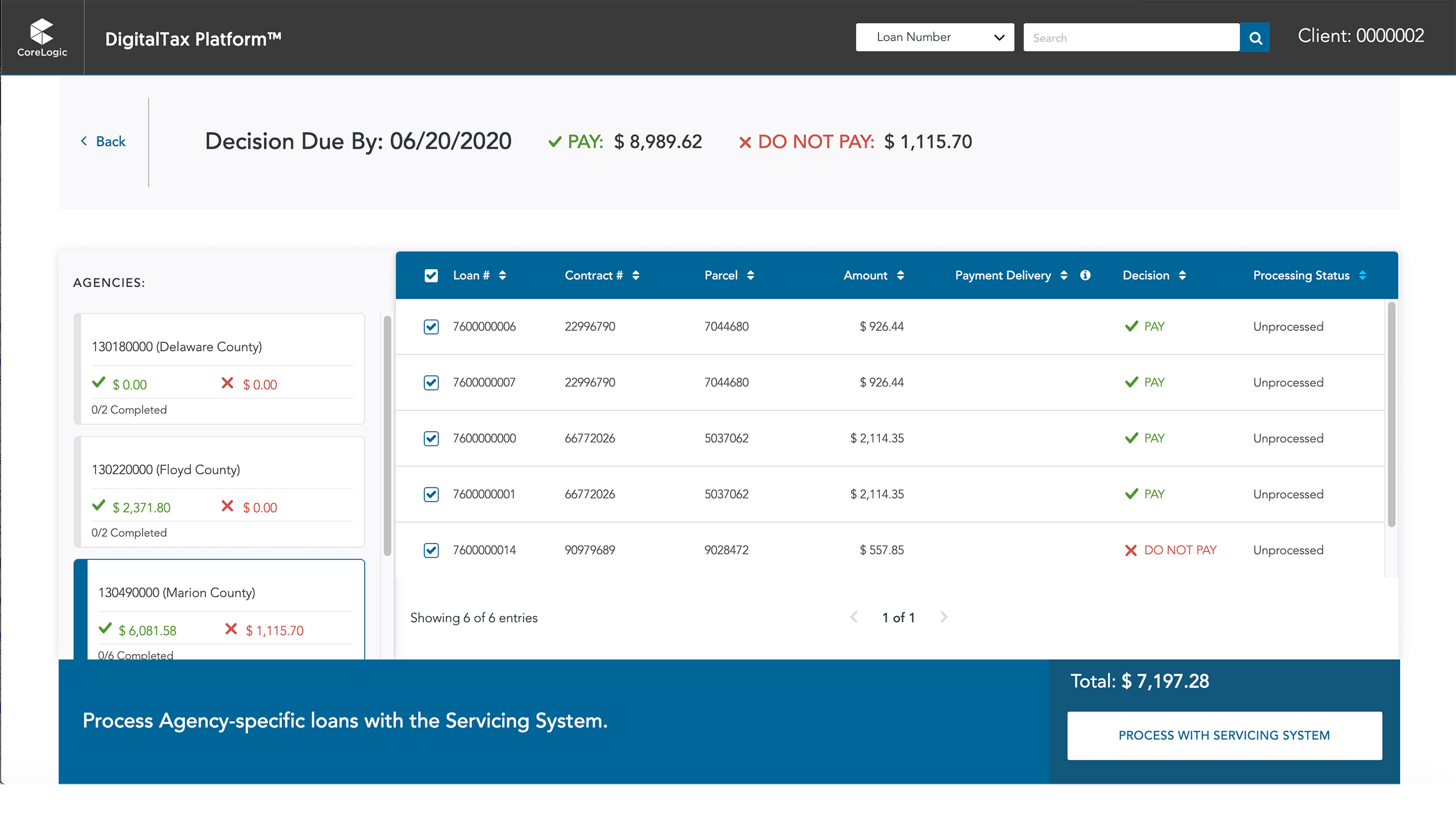

Therefore they would only pay property taxes on 150000. Keep in mind that other tax buyers may be thinking what youre thinking. As the foundation for CoreLogic residential real estate tax and payment solutions the DigitalTax Platform transforms your tax service performance by facilitating near real-time data exchange between servicers borrowers and taxing authorities.

In addition CoreLogic manages one of the largest real estate databases used to procure store and pay property tax amounts as well as to maintain payment status. That you only need to bid the 3000 in back taxes or whatever the number actually is to get the property but if other tax buyers suspect that the owner is missing and they too can get ownership of the home the bidding may go up and may be much more than what is owed in taxes. A 26 service fee is added by our third-party vendor for use of a credit card.

Escrow accounts are set up to collect property tax and homeowners insurance payments each month. Tax Service Specialist Former Employee - Rochester NY - December 30 2017 work cases to fix and pay property taxes for homeowners. Core Logic Paying Property Taxes.

Bank of America did not provide CoreLogic any records of my account. Scambooks investigation team reached out to this company a total of 4 times Scambook Investigators last contacted them on Feb 21 2013. CoreLogic listed as last tax payer.

The duration of redemption periods varies by state law but it can be as long as a year. The town records show only payments no refunds for property taxes and CoreLogic has failed to provide documentation that I received a financial gain. Lenders expect borrowers who do not have escrow account to pay their property taxes when due.

CoreLogic on the other hand has built near real-time integrations with many of these entities. Please note that all salary figures are approximations. They waited another three years to actually inform me today of the issue.

To call for a payment reversal. This fee goes entirely to the vendor. CLGX a leading global property information analytics and data-enabled services provider today announced the completion of the companys acquisition of National Tax Search LLC NTS.

Yes your mortgage company can pay your delinquent property taxes without your authorization. NTS provides comprehensive property tax management services to lenders real estate investment trusts. If you erroneously pay your taxes by e-check you have until 5 pm.

I have an issue to come up where another company called CoreLogic who mistakenly paid my property tax bill for three years. They imply that they sent to the money to Bank of America who said they credited it to my escrow account at that time. Since then the page has accumulated 1 consumer complaint.

The highest median property tax rate is 267 and that is in Illinois with Hawaii being the lowest at 31 but would would want to live in Hawaii with the picture perfect beaches ridiculously beautiful. A 195 service fee is added for debit cards. Salary information comes from 15 data points collected directly from employees users and past and present job advertisements on Indeed in the past 36 months.

In the case of a tax sale certificate rather than sale of the property the homeowner can usually redeem the certificate by paying the purchaser the amount of taxes paid on their behalf plus interest and possibly penalties. CoreLogic didnt pay the property taxes for 490 confidential property owners in Dallas County alone Dallas County Tax AssessorCollector John R. If CoreLogic is listed as the last tax payer on a property does this mean they probably have ownership of the property.

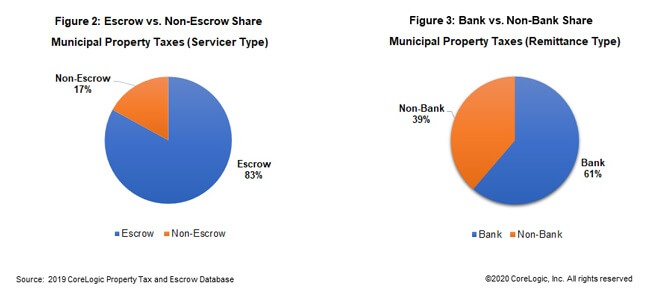

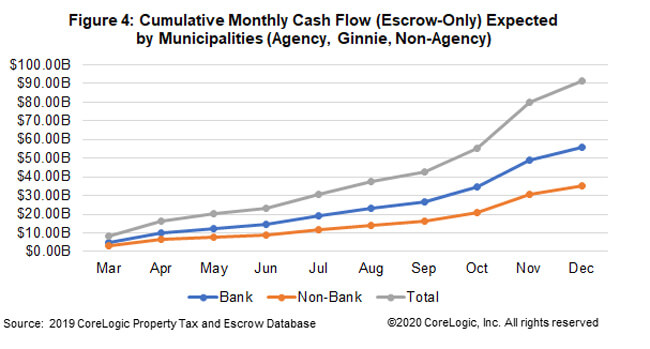

2 of 150000 adjusted assessed value 3000. A 100 Tax Exemption means that you do not have to. As the largest provider of property tax and escrow services to the single family residential mortgage markets CoreLogic is uniquely positioned to size the universe of escrowed property tax payments expected to be advanced by servicers over the course of the remainder of 2020 including what the outer-boundary of potential risk exposure to municipalities may look.

And what does CoreLogic do exactly.

Sizing The Risk Of Property Tax Revenue Disruption To Municipalities Corelogic

Residential Property Tax Solutions Corelogic

Corelogic Property Data Leader Property Solutions

Residential Property Tax Solutions Corelogic

Residential Property Tax Solutions Corelogic

Mortgage Calculator Home Mortgage Amortization Schedule Calculator Watch Thi Amortiz Amortization Schedule Online Mortgage Mortgage Amortization Calculator

Realtorlocke Closingcosts Nhrealestate Closing Costs Denver Real Estate Things To Know

Taxq Services National Tax Search Corelogic

Taxq Services National Tax Search Corelogic

About National Tax Search National Tax Search Corelogic

Kcm Graphic 333 Feed Real Estate Information Homeowner Financial Position

Real Estate Property Data Solutions Corelogic

National Average Property Tax Delinquency Rate Declines In 2021 Corelogic Reports

Corelogic To Be Acquired For 6 Billion Thestreet

What Impact Will The New Tax Code Have On Home Values Rental Property Investment Real Estate Home Ownership

Sizing The Risk Of Property Tax Revenue Disruption To Municipalities Corelogic

Mortgage Industry Fires Back At Regulator Who Refuses To Help Servicers Getting Slammed By Payment Delay Requests Financial News Finance Mortgage